Have you ever thought about investing in dividends? It’s a great way to generate passive income over time. But before you dive in, there are a few things you need to get started.

First, you need to have a brokerage account. This is where you’ll buy and sell stocks. Take some time to research different brokerage firms and find one that suits your needs and offers low fees. Brokerage accounts like Fidelity, TD Ameritrade are long standing firms that have plenty of tools to help you navigate the financial landscape. They also do not charge commissions on trades or have monthly fees for having your account open.

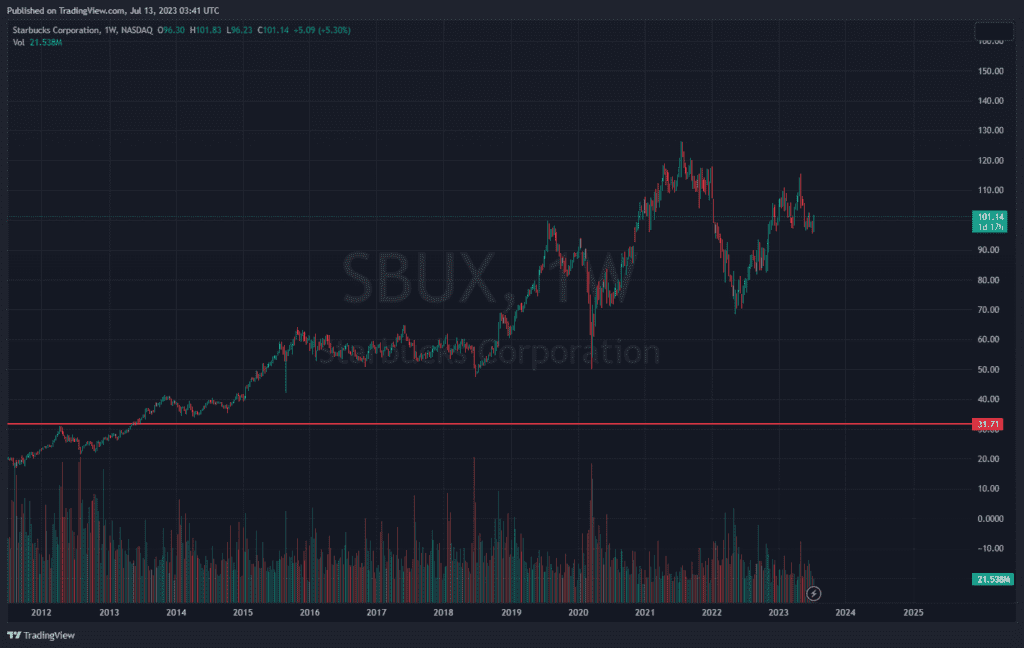

Next, you’ll need to do your homework and choose the right dividend stocks. Look for companies with a solid track record of paying dividends consistently. Research their financial health and stability. Remember, you want to invest in companies that are likely to continue paying dividends in the long run.

Once you’ve selected your dividend stocks, it’s important to diversify your portfolio. Don’t put all your eggs in one basket. Spread your investments across different sectors and industries. This will help reduce the risk and increase your chances of success. You may also want to consider finding dividend paying ETF’s such as SCHD or DRGO as they are very diversified and do a great job of finding these great dividend paying stocks.

Another thing you’ll need to consider is your investment strategy. Are you going to focus on high-yield dividend stocks or companies with consistent dividend growth? Are you going to do lump sum investments when you think the market is low? Are you going to dollar cost average every week ro month regardless of price? Make sure you have a plan in place and stick to it.

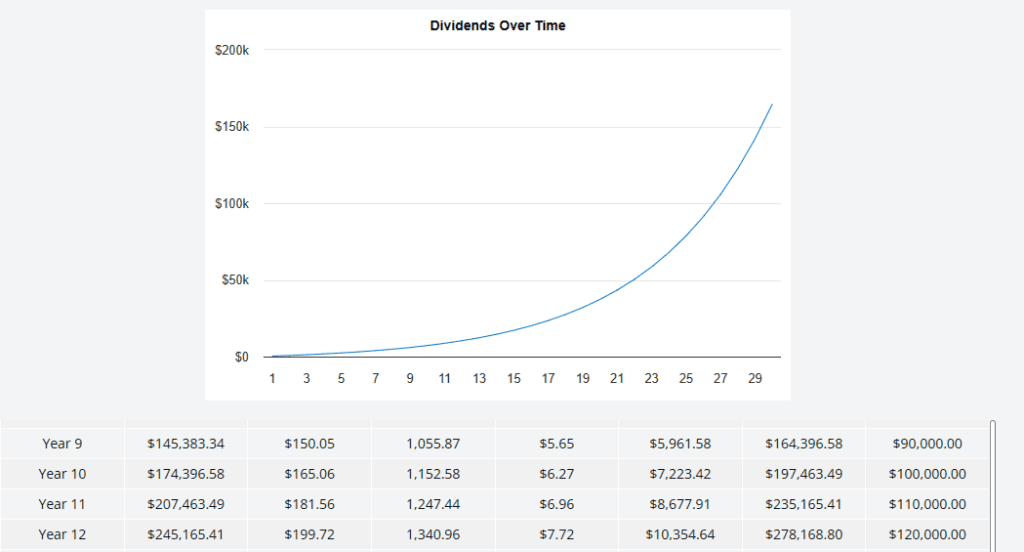

Lastly, you need to be patient. Dividend investing is a long-term game. It’s not about making quick profits, but rather building wealth over time. So, stay committed and allow your investments to grow and compound. The Power of Compound interest is what truly carries a portfolio and it works best with time.

So You Need:

- A brokerage account

- A general idea of your dividend paying stocks

- Diversification

- An investment strategy and

- Patience.