Short Answer, Yes.

However I like to think it is a bit more nuanced than that. Living off dividends requires in my honest opinion two things, patience and capital. Breaking this down we see that the SP 500 has increased dividends almost every year. Meaning as the stocks grow the dividends grow along with them. Companies make more money and start paying out more to share holders. So knowing this fact we know this can lead to creating a perpetual increase in income. If we want to start living off our dividends while we are at least middle aged then patience will only take us so far we will need a significant amount of capital in order to achieve our goals.

I’m sorry but there is no other way around this. I am an intense advocate for dividend investing as that is the ultimate goal. We want to have a significant portfolio size that we can withdraw cash flow from whether to live off or use for other endeavors. Increasing our portfolio size can happen two ways choosing higher risk reward stocks and hoping they 10x and/ or having a sizable yearly contribution into our accounts that will allow us to accumulate shares quickly. As we accumulate shares the power of compounding really starts to take effect and if we can combine that with dividend reinvestment cash flow will begin to skyrocket.

Living off dividends isn’t luck. This will be a consistent grind that will require consistency in your investment plan. This will also require disposable income that you will not need for at least 10 years. The types of investments you want to seek should be a mix of growth and income. 10 years is a long time and neglecting growth stocks would be very detrimental. The reason I say this is because the capital growth from investing in say tech and semiconductors will outperform most dividend growth stocks. Once these are a part of your portfolio you can always rotate them into dividend stocks as they grow and you wish to increase cash flow.

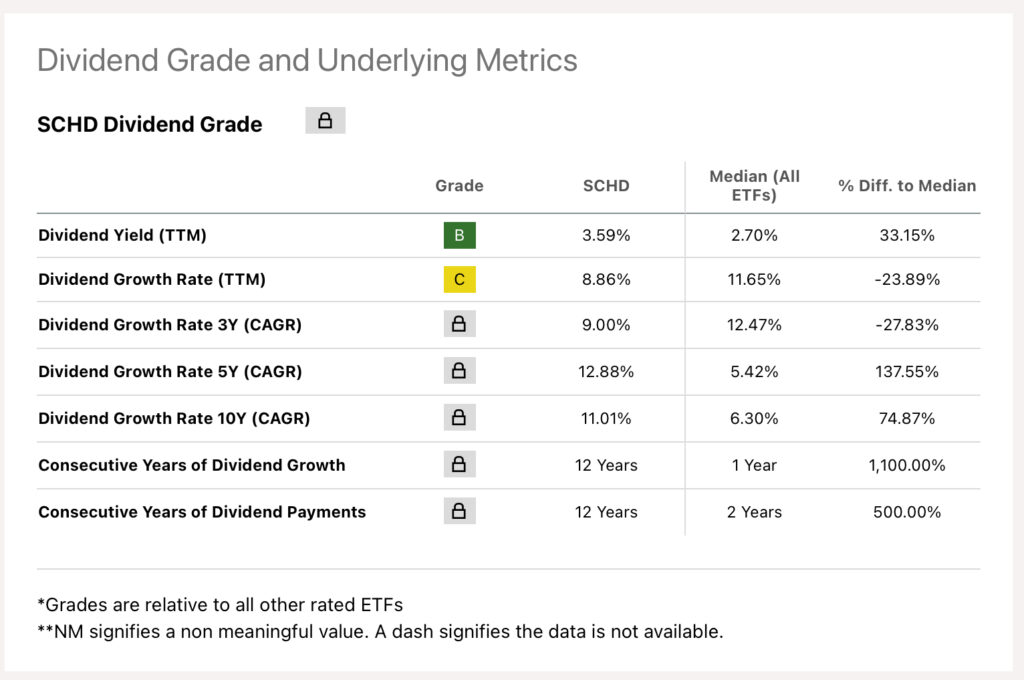

Once the portfolio reaches a significant size say 1,000,000 now we can begin to rotate into higher yielding stocks say something like SCHD, JEPQ, REITS that can boost the yield to around 5-6%. This should generate $50,000 a year. The key here would be to ensure that the capital continues to grow and the dividends continue to grow. So at this stage it would be wise to choose companies and ETF’s with a consistent track record of growth and dividend growth. This is why so many dividend investors love SCHD as they have proven to invest in companies that can moderately grow and increase dividend payouts.

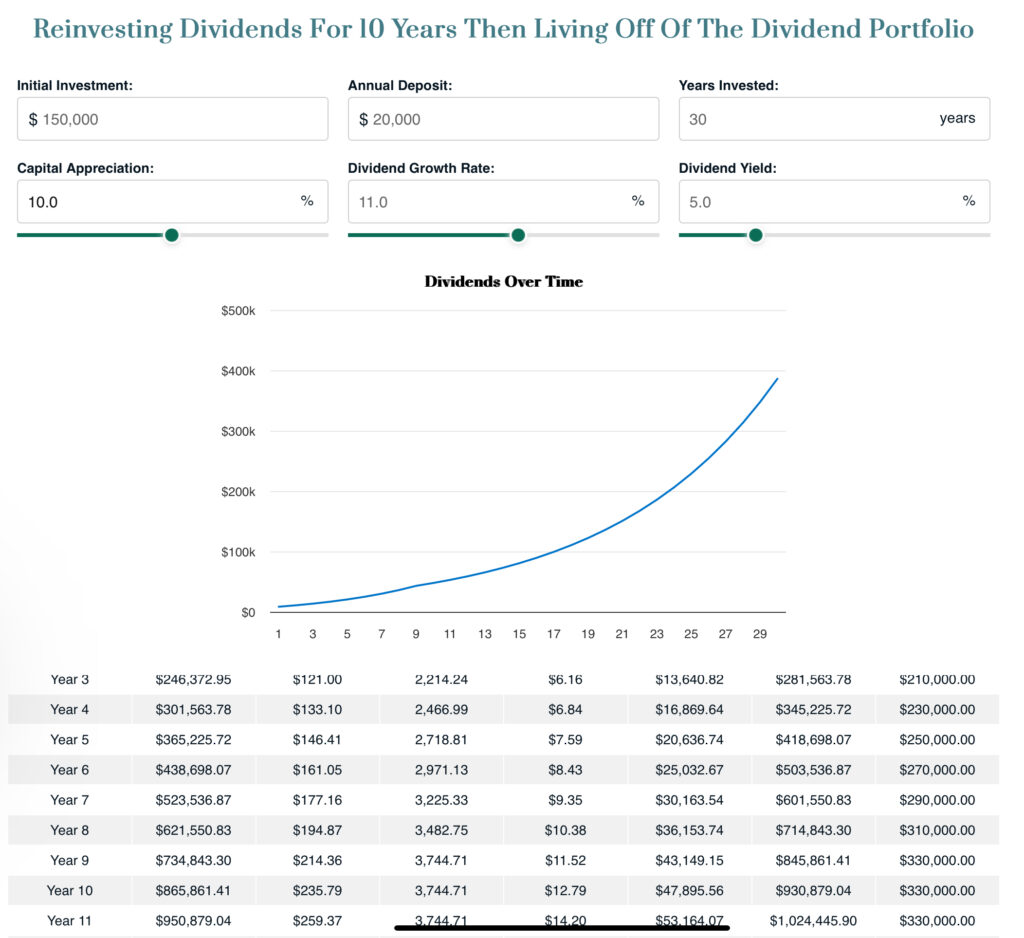

Of course no one knows what the markets are going to do and how they will perform over a decade. However we can all project what we may need to live off dividends using the living off dividends calculator. This calculator can demonstrate how a 10 year investment plan can continue to produce cash flow long after you stopped investing and began using dividend payments for cash flow. It can be done and will require two things, Patience and Capital.