In the world of investing, there are many strategies that individuals can use to maximize their returns. Two popular approaches are XLK and QQQ growth investing. XLK is an exchange-traded fund (ETF) that tracks the technology sector, while QQQ is an ETF that tracks the Nasdaq 100 index. Both strategies aim to identify companies with strong growth potential and invest in them for the long term. However, there are some key differences between the two that investors should consider before choosing which one to pursue. In this article, we will explore the similarities and differences between XLK and QQQ.

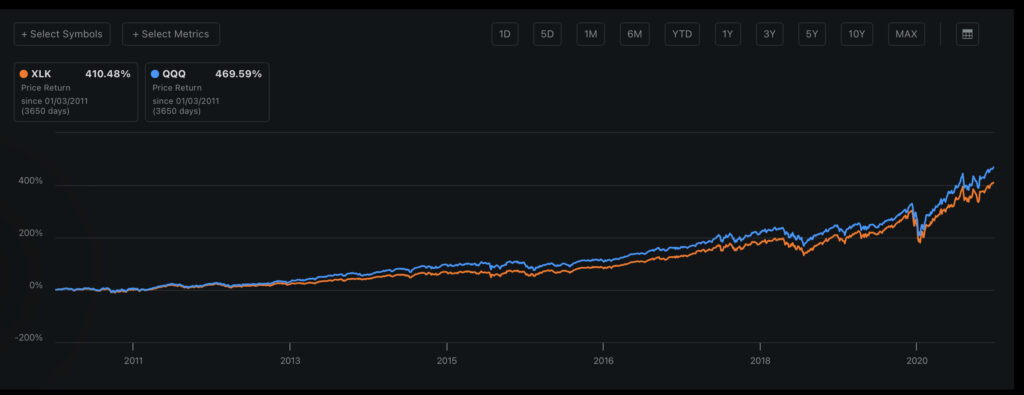

Over the past decade, both the Technology Select Sector SPDR Fund (XLK) and the Invesco QQQ Trust (QQQ) have delivered impressive returns for investors. While the XLK ETF tracks the performance of the S&P 500 technology sector, the QQQ ETF tracks the performance of the Nasdaq-100 Index, which includes companies across various industries but with a heavy weighting towards technology. Looking at the 10-year returns of both funds, we can see that QQQ has outperformed XLK by a significant margin. As of August 2021, QQQ has delivered a 10-year annualized return of 28.81%, compared to XLK’s 10-year annualized return of 20.53%. This difference in returns can largely be attributed to the fact that QQQ has exposure to high-growth companies such as Apple, Amazon, and Microsoft, which have been some of the best-performing stocks in recent years. However, investors should keep in mind that past performance is not necessarily indicative of future results, and that both funds come with their own set of risks and considerations.

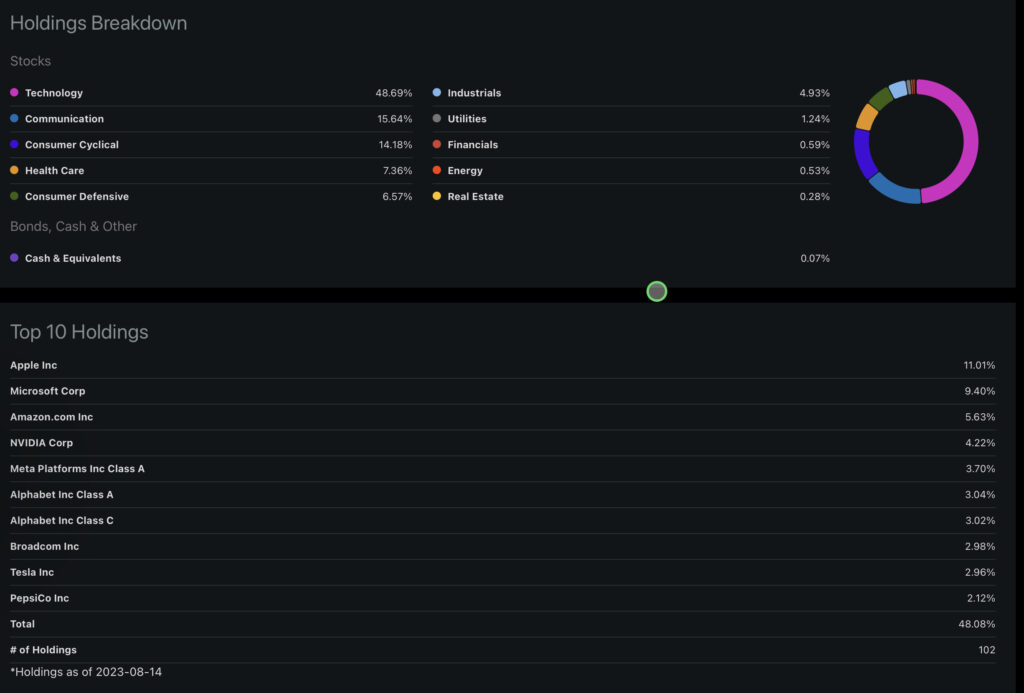

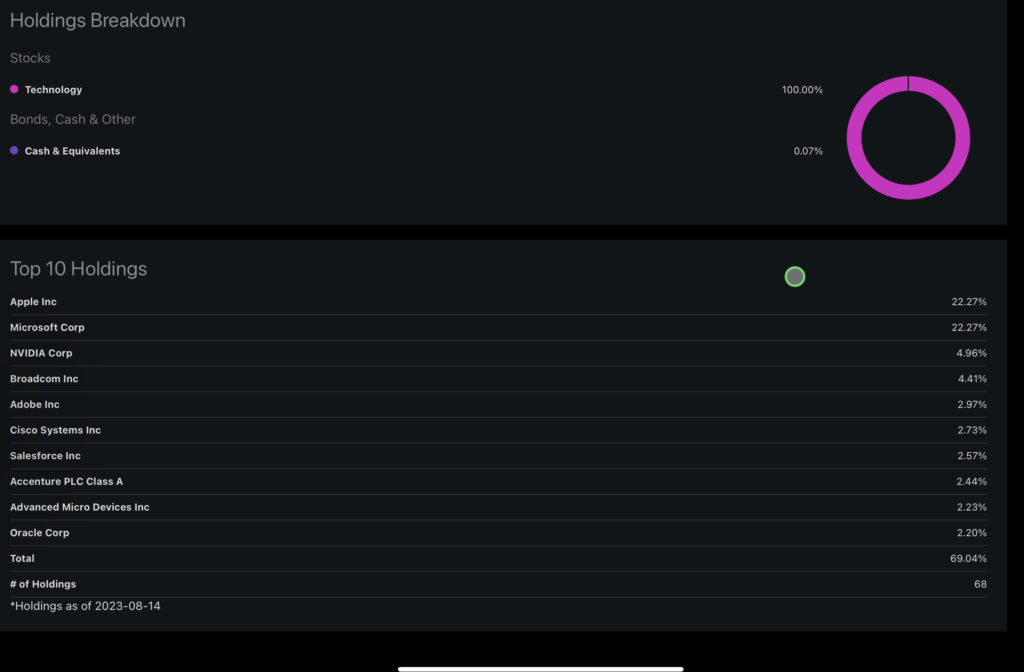

Diving Deeper into the differences between XLK and QQQ we can see that they end up being fundamentally different because of the concentration in the different sectors of the Market. The QQQ pides itself in being diversified across the different sectors investing in healthcare, consumer staples etc. Meanwhile the XLK is a pure investment in technology companies in the SP 500. This difference can lead to some very different outcomes for a long term investor and depending on whether an investor wants more exposure to the technology sector or not will determine which investment may be the better option.

As of July 2021, Apple and Microsoft are the top two holdings in both ETFs. However, XLK has a higher weighting towards Apple, with a 23.4% allocation, while QQQ has a higher weighting towards Microsoft, with a 10.4% allocation. In addition to these two tech giants, XLK’s other top holdings include Nvidia, PayPal, and Visa, while QQQ’s other top holdings include Amazon, Tesla, and Alphabet (Google). By observing the holdings you can better asses which ETF is better for you depending consistent investing strategy whether you choose XLK or QQQ.

In conclusion, investing in technology stocks can be a profitable option for investors seeking long-term growth. Choosing between XLK and QQQ can be a tough decision, but it ultimately depends on your personal investment goals and risk tolerance. The key to success is to develop a consistent investing strategy and stick to it. This means doing your research, diversifying your portfolio, and rebalancing periodically. By following these principles, you can maximize your returns and minimize your risks, regardless of which tech ETF you choose.