Understanding how to use a Dividend Calculator was one of the most important things you can learn to do when you first start to invest. A dividend calculator is a powerful tool that can allow you to project future payments and share price growth in your desired equity. When starting your dividend investing journey one of the first things you dream of is achieving that ever elusive passive income that can actually free you from your 9-5. To be free from the 9-5 there is a yearly number in passive income you must achieve. Once you decide that number or have that number in mind you are ready to start using the dividend calculator. For our example we will use an estimated annual income of $75,000.

Understanding Dividend Yield, Capital Appreciation and Dividend Growth

Now that we have our income goal in mind we start by diving into 3 key concepts that every dividend investing must understand. dividend yield, capital appreciation and dividend growth. These concepts are the building blocks and all must be taking into consideration especially when attempting to build a high quality dividend portfolio over the long term.

Dividend Yield is the percentage amount per year that a stock will pay out. This payout amount is taken by dividing the Dividend Yield Percentage by the share price. Ex. Company X with a share price of $100 has a dividend yield of 2% will pay $2 per year/per share. Most companies pay out dividends quarterly so that original amount can be divided by 4 to see how much would be earned every 3 months.

Capital Appreciation is a percentage of how much the share price of a stock will grow through any given year. This number should be looked at over a long period of time. Ex. The SP 500 has a share price appreciation of 16.8% over the last 10 years (at the time of this writing). This is an average where some years are more and some are less. However it provides viewpoint to begin your calculations.

Dividend Growth Rate is every dividend investors favorite part of dividend investing. This figure shows how much the dividend payment itself will grow. Lets go back to our previous example. Company X with a share price of $100 now in its second year boost the yearly payment to $2.20 per share. That is a 10% increase in dividend payments whether the share appreciated in value or not. These companies that produce consistent dividend increases continue to shell out more value to their investors by producing them more cash flow.

Inputting Data into the Calculator

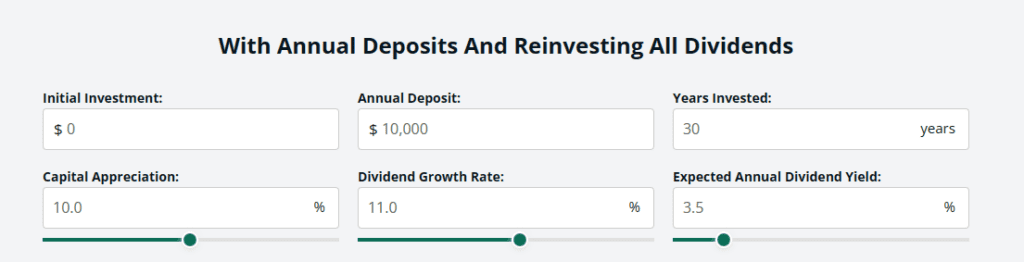

Now that we know the 3 pillars of dividend investing its time to input the information into the calculator. To begin we must have an idea of which dividend stock or ETF we wish to use to help us get rid of our 9-5. We will be using SCHD a very popular and effective dividend growth ETF with an excellent track record of holding dividend paying companies that grow overtime. This ETF has a dividend yield of 3.5%, a Capital Appreciation Rate of 10% and a dividend growth rate of 11%. Now that we have done the research, found our preferred investment vehicle and found our numbers we are ready to do some calculations.

Calculating Dividend Income

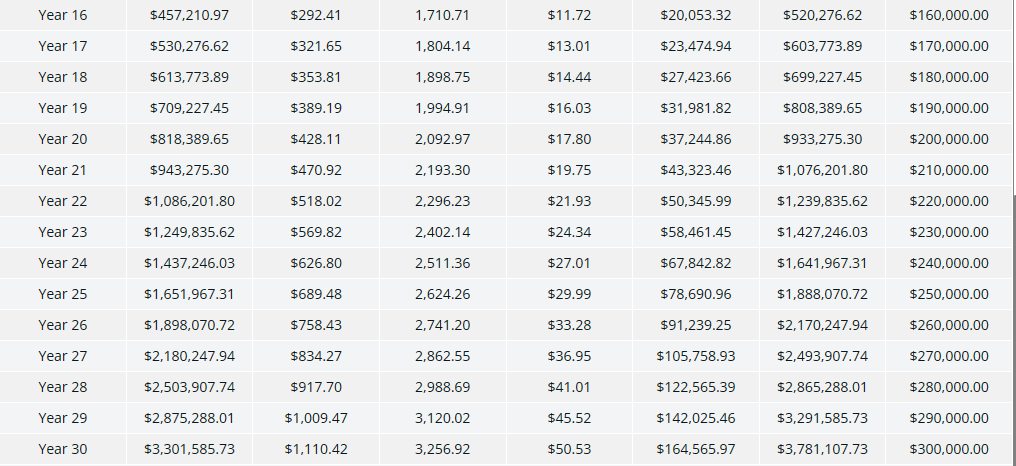

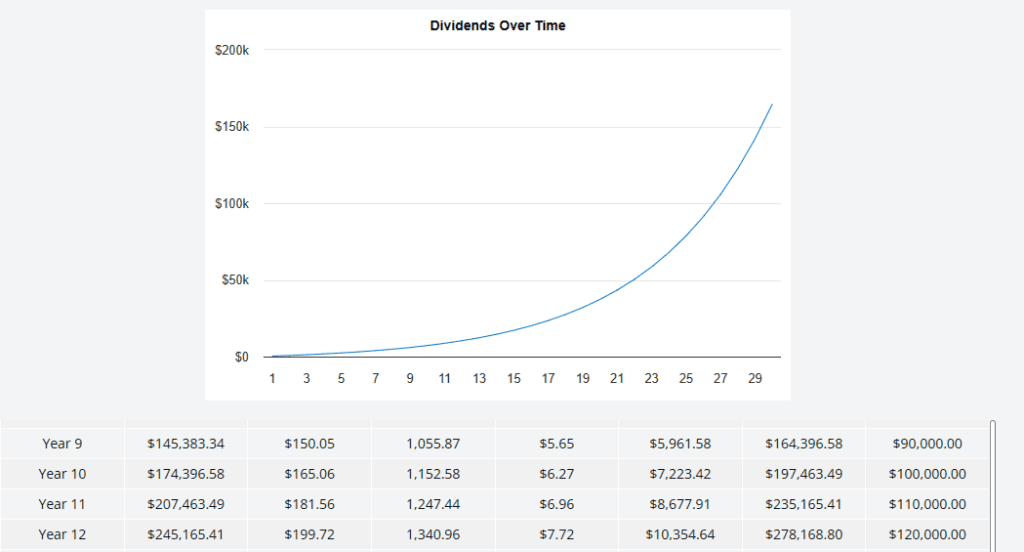

As we begin our calculations we will start with a $0 initial investment and we will commit to a $10,000 annual contribution or roughly $833 dollars per month and we will keep a 30 year investment timeline. We now see that in roughly 24-25 years our dividend income at this rate of investment will produce an annual income of $78,000 well above our $75,000 goal. Our portfolio will also be worth a cool $1.65 million. This is the true power of dividend investing and reinvesting dividends until your goals are reached.

We can see in the example that in years 1-12 our annual dividend payments barely get to over $10,000. This is no small amount of money but seems like a long shot to get to 75,000. However as you continue to invest, reinvest dividends and you experience more share price appreciation and dividend growth by year 22 just 10 more years this annual distribution has nearly grown by 5.

Comparing Different Investment Opportunities

Of course we have our contrarians, for what you sacrifice in dividend paying stocks is face ripping growth. Names like Amazon, Tesla, Google do not pay dividends as of the time of this writing but they have seen share price growth that has been incredible. This is where investment strategies and understanding your risk tolerance comes into play. These big tech names experience growth but they also experience wild swings and for some that may be to much to stomach.

Another concept most dividend investors face is the possibility of going after higher yielding stocks. However one should be cautious as some stocks and ETF’s with high yields may have fantastic payments but underlying assets may in fact be depreciating. However if your in the enjoyment phase of your dividend journey perhaps having some higher yielding stocks may prove beneficial to boost yearly dividend payments.

Whatever you chose it is important to understand the risk involved. No investment is ever 100% guaranteed and there is no wrong or right way to invest. Every investors goal is different. The key is to find what works for you.

Happy Investing!