Hello investors,

Have you ever heard of the saying “once in a lifetime opportunity”? It’s a phrase that gets thrown around a lot in the investing world. From stock market booms to real estate bubbles, people are constantly looking for that one big opportunity that will change their lives forever. But the truth is, once in a lifetime opportunities happen all the time in markets.

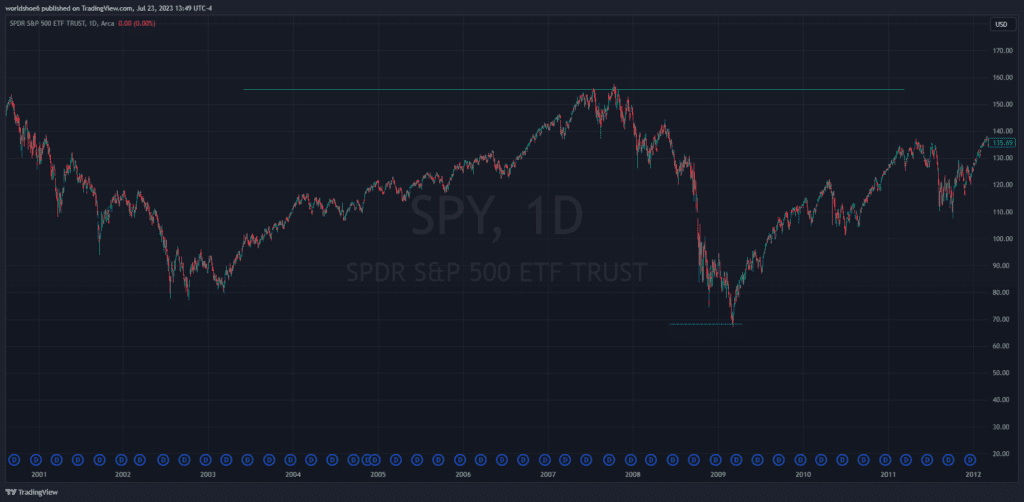

Let’s take a look at some examples. In 2008, the stock market crashed and many investors lost a lot of money. But for those who were brave enough to invest during that time, they were able to buy stocks at incredibly low prices. Fast forward to today, and those same stocks have skyrocketed in value. That was a once in a lifetime opportunity that happened just over a decade ago.

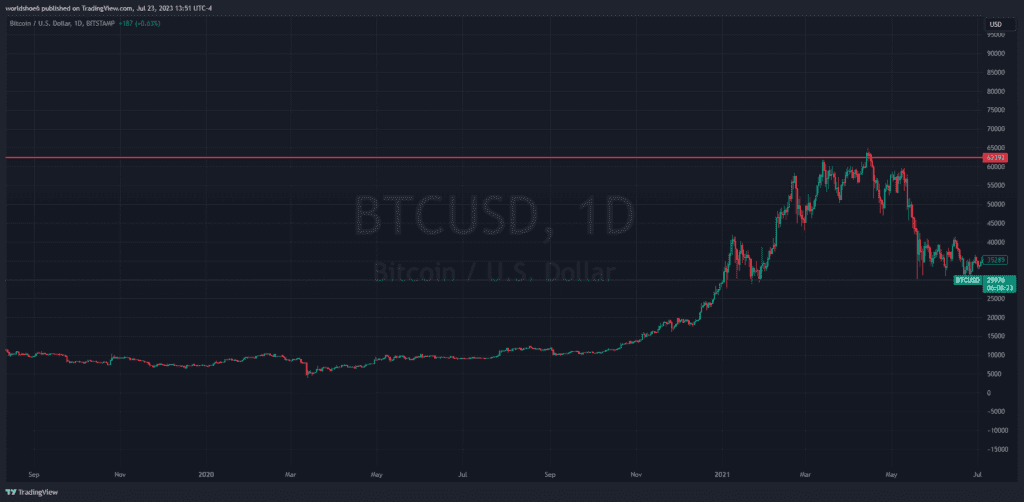

Another example is the recent rise of cryptocurrencies. In just a few short years, Bitcoin went from being worth almost nothing to over $60,000 per coin. Those who invested early on were able to reap massive rewards. While there is no guarantee that cryptocurrencies will continue to rise in value, it’s clear that this was a once in a lifetime opportunity that many people took advantage of.

But the thing is, these opportunities happen all the time. The key is being able to spot them and take advantage of them. So how can you do that?

- Research

- Timing

- Diversify

- Have a long term Mindset

Research

First and foremost, you need to do your research. Keep up to date with the latest news and trends in the market. Look for industries that are on the rise, and companies that are poised for growth. Make sure you have a solid understanding of the risks involved, and don’t invest more than you can afford to lose.

Timing

Another important factor is timing. If you wait too long to invest, you may miss out on the opportunity altogether. But if you invest too early, you may not see any returns for years to come. It’s a delicate balance that requires careful consideration.

Diversify

One way to mitigate risk is to diversify your portfolio. Don’t put all your eggs in one basket. Spread your investments across different industries and asset classes. This can help protect your investments if one sector experiences a downturn.

Long Term Thinking

It’s also important to have a long-term mindset. While it’s tempting to try and make quick gains, the most successful investors are those who think long-term. Don’t get caught up in the hype of the latest hot stock or trend. Instead, focus on building a solid portfolio that will grow over time.

In conclusion, once in a lifetime opportunities happen all the time in markets. The key is being able to spot them and take advantage of them. Do your research, diversify your portfolio and think long term. By following these principles, you’ll be well on your way to building a successful investment portfolio.