Today I wanted to talk about a well-known company that may be a good fit in your dividend investing journey. That company is Starbucks. The reason I want to talk about this company is because when it comes to dividend investing most people don’t include it. The reason is because of its relatively low yield at just 2.08% as of the time of this video.

However, what people fail to mention is the incredible dividend growth this company has witnessed. In this video I want to show you how Starbucks and similar companies can play a crucial role for dividend investors.

At a current share price of $101 a dividend yield of 2.08% would payout $2.12 per share/per year. But lets take this scenario and rewind to just 10 years ago. Starbucks would have had a share price of just over $34 dollars and a dividend of $.44 a yield of 1.35%. What do we notice? Not only did share price increase but the dividends increased as well. This number seems small but understand that buying and holding shares in this scenario would have performed very well.

Assume 100 shares in 2013 a $3400 investment, with an annual payout of $44. The investment is now worth $10,100, with an annual payout of $212. That is a 481% increase in payout in 10 years. This stock has seen capital appreciation at 18% average annually and a 17.92% dividend growth rate over 10 years. Not bad and beating the market by about 10%.

Starbucks has been great for investors over the last 10 years. Of course we don’t have a crystal ball and no one knows how Starbucks will grow in the future. But let’s take these numbers and plug them into the bestdividendcalculator.com and see how regular investments starting from 0 will look.

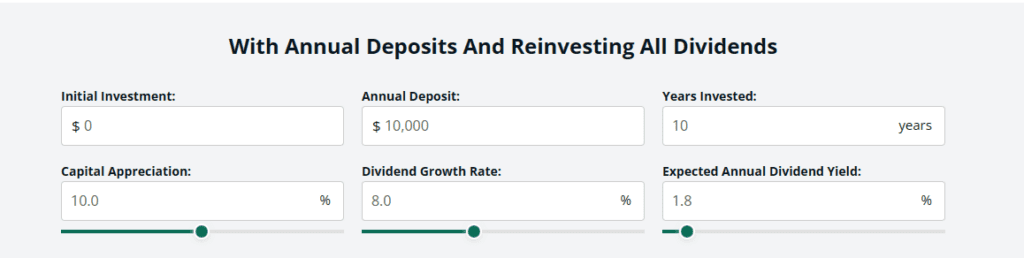

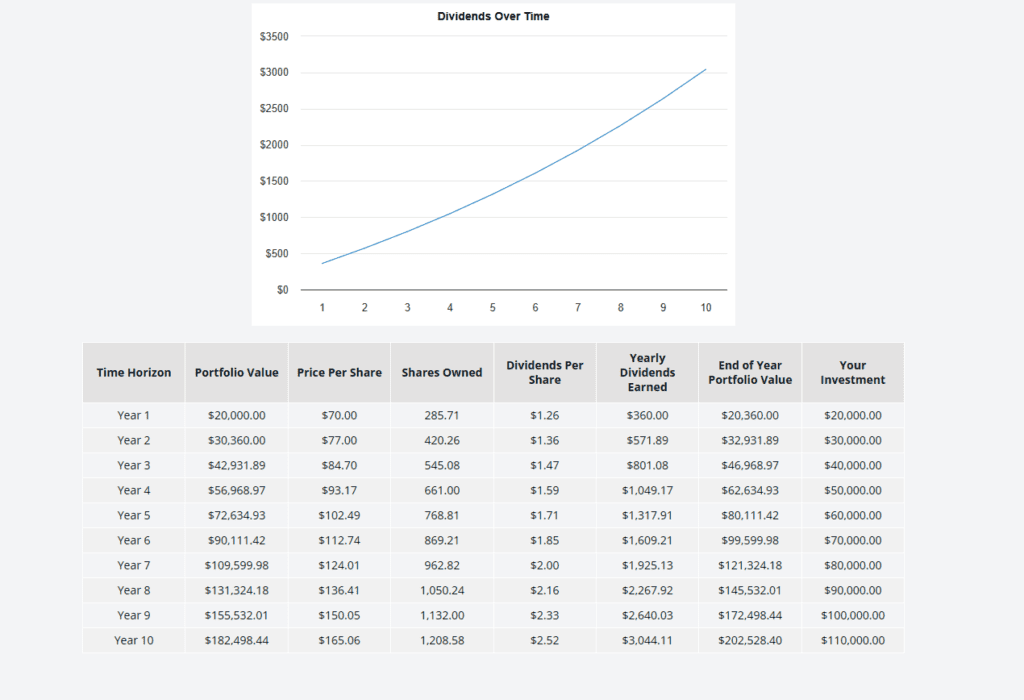

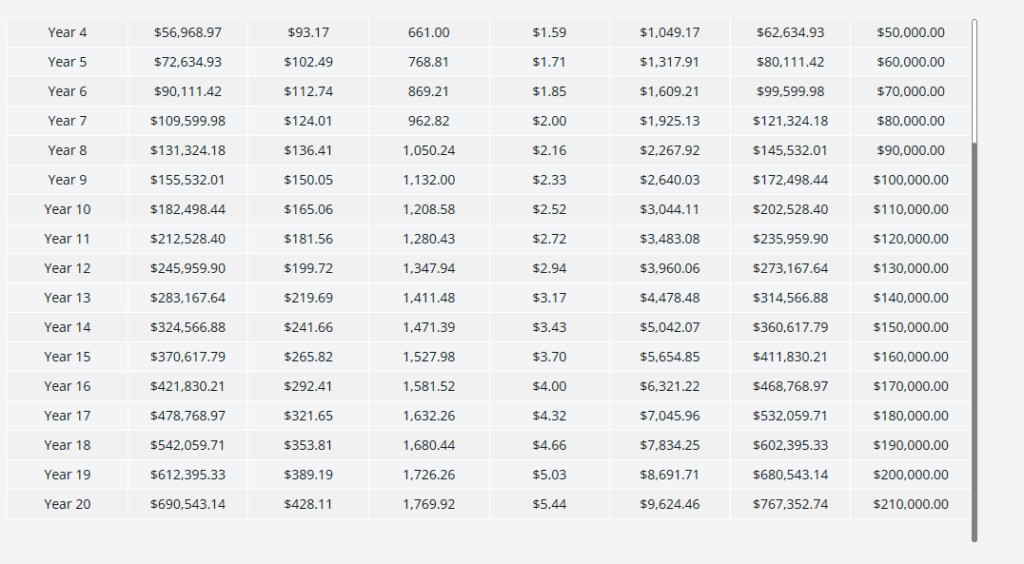

We will start with a 10% capital appreciation, an 8% Dividend growth rate and a Dividend Yield of 1.8% for an additional 10 years. We see that at the end of 10 years, with yearly investments of $10,000 we are left with a portfolio of Starbucks worth $202,000. Yearly Dividends of $3044. Our total contributions were $110,000, we achieved an $92,000 return. This was based on a monthly contribution of $830 which is no small amount of money.

But ask yourself is it worth the sacrifice?

We will start with a 10% capital appreciation, an 8% Dividend growth rate and a Dividend Yield of 1.8% for an additional 10 years. We see that at the end of 10 years, with yearly investments of $10,000 we are left with a portfolio of Starbucks worth $202,000. Yearly Dividends of $3044. Our total contributions were $110,000, we achieved an $92,000 return. This was based on a monthly contribution of $830 which is no small amount of money.

But ask yourself is it worth the sacrifice?

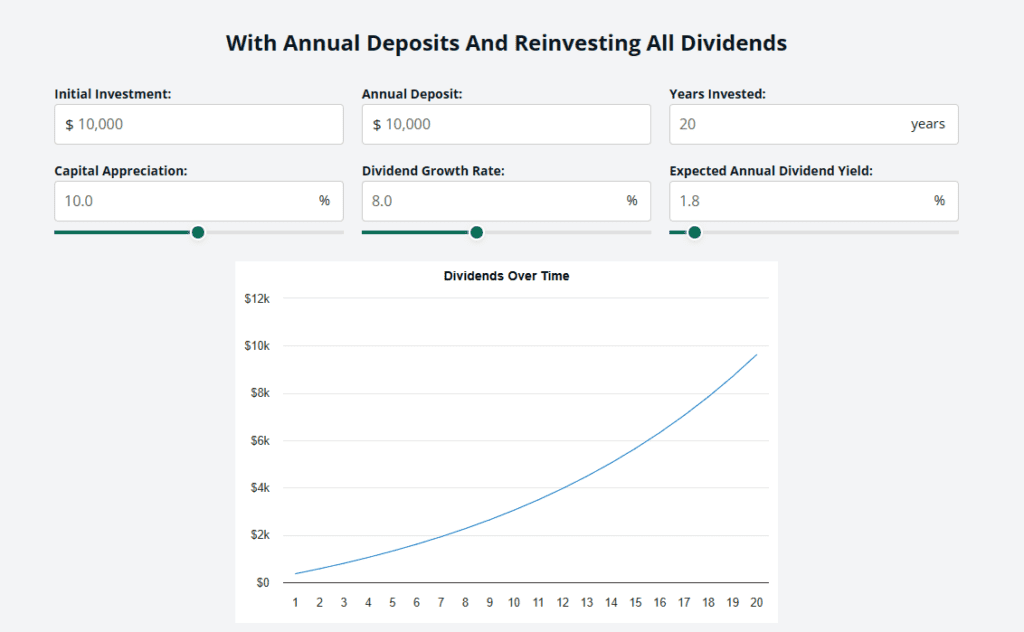

Lets push this one step further. Lets push the timeline out for 20 years. We see that we now have a portfolio of $767,000 with total contributions of only $210,000. Annual dividend payments of $9,000. Not bad I would say. This is all said to show you the power of compounding returns and reinvesting dividends works.

Lets push this one step further. Lets push the timeline out for 20 years. We see that we now have a portfolio of $767,000 with total contributions of only $210,000. Annual dividend payments of $9,000. Not bad I would say. This is all said to show you the power of compounding returns and reinvesting dividends works.

Your greatest ally is time.

Your greatest ally is time.

We will start with a 10% capital appreciation, an 8% Dividend growth rate and a Dividend Yield of 1.8% for an additional 10 years. We see that at the end of 10 years, with yearly investments of $10,000 we are left with a portfolio of Starbucks worth $202,000. Yearly Dividends of $3044. Our total contributions were $110,000, we achieved an $92,000 return. This was based on a monthly contribution of $830 which is no small amount of money.

But ask yourself is it worth the sacrifice?

We will start with a 10% capital appreciation, an 8% Dividend growth rate and a Dividend Yield of 1.8% for an additional 10 years. We see that at the end of 10 years, with yearly investments of $10,000 we are left with a portfolio of Starbucks worth $202,000. Yearly Dividends of $3044. Our total contributions were $110,000, we achieved an $92,000 return. This was based on a monthly contribution of $830 which is no small amount of money.

But ask yourself is it worth the sacrifice?

Lets push this one step further. Lets push the timeline out for 20 years. We see that we now have a portfolio of $767,000 with total contributions of only $210,000. Annual dividend payments of $9,000. Not bad I would say. This is all said to show you the power of compounding returns and reinvesting dividends works.

Lets push this one step further. Lets push the timeline out for 20 years. We see that we now have a portfolio of $767,000 with total contributions of only $210,000. Annual dividend payments of $9,000. Not bad I would say. This is all said to show you the power of compounding returns and reinvesting dividends works.

Your greatest ally is time.

Your greatest ally is time.